As Product Managers and Leaders, we’re wired to solve problems. When we see a customer pain point, our instinct is to jump straight into ideation mode, brainstorming elegant solutions that will wow users and make their lives easier. After all, that’s what we’re hired to do, right? Ship products that make a difference.

But here’s the hard truth: our “brilliant” solutions are meaningless if they don’t solve the right problem. In our eagerness to build and ship, we often neglect the most crucial step—deeply understanding our customers’ needs, desires, and struggles.

I’ve fallen into this trap myself countless times. Early in my career, I poured my heart into building a feature I was convinced would be a game-changer, only to see the results be a little… meh. The reason? I hadn’t taken the time to truly validate my assumptions about what users needed. I was solving for my perception of the problem, not the actual customer reality.

Here’s the thing: our customers are not designers, and it’s not their job to hand us the perfect solution on a silver platter. As the famous quote from Henry Ford goes, “If I had asked people what they wanted, they would have said faster horses.” Okay, even if he didn’t actually say that (rumor is, it’s just an urban legend)… the point still stands. Our responsibility as Product Managers is to uncover the deeper, often unspoken needs and craft solutions that address the root cause, not just the surface-level symptoms.

But how do we do that? How can we confidently define the right problems to solve and ensure our products deliver real value? The answer lies in mastering the art of learning from our customers.

There are lots of ways we can do that, and I’ll share just some of the things that are helpful to me, personally, when learning from customers – which include:

- The Product-Market-Fit Pyramid and the critical importance of nailing the problem space before the solution space

- The Jobs-to-be-Done (JTBD) framework for uncovering the true “job” your product is hired to do

- Techniques for conducting revealing customer interviews that unearth hidden insights

- When to use quantitative vs. qualitative research methods, and the pros and cons of each

- Tips for building a continuous customer learning process

Whether you’re working on an early-stage product or iterating on a mature one, the principles and tactics covered here will help you as you think of ways to learn from customers. You’ll learn how to validate your riskiest assumptions, identify the highest-impact opportunities, and ultimately, ship products that solve real problems and create meaningful value.

Let’s dive in…

The Pitfall of Over-Focusing on the Solution Space

Be honest – are you often pressured to move fast and ship quickly? Of course you are. You’re a product person. Agile development, rapid prototyping, and the lean startup methodology have conditioned us to believe speed is king. And while there’s certainly value in swift execution, it becomes dangerous when we prioritize speed over genuinely understanding the problem we’re trying to solve.

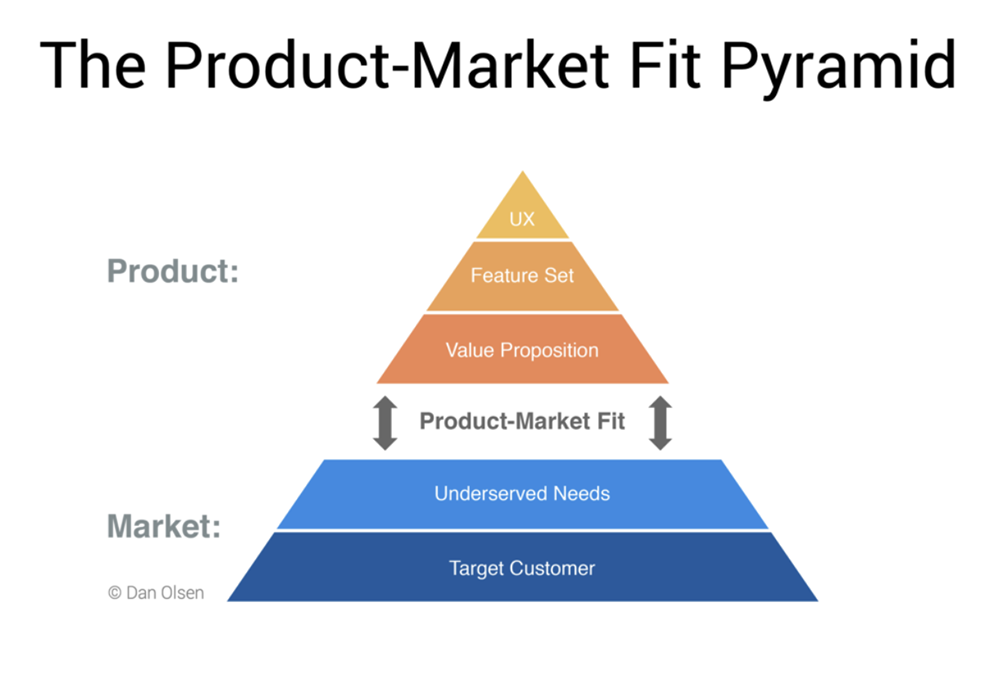

This is where the Product-Market-Fit Pyramid – a concept introduced by Dan Olsen in his book The Lean Product Playbook, comes in. The pyramid visually illustrates the factors contributing to product-market fit, with the most foundational layer being the “Target Customer” and their underserved needs. Only after deeply understanding this “problem space” should we move up the pyramid to define our value proposition, feature set, and UX.

However, as Olsen points out, most product teams spend most of their time at the top of the pyramid, in the “solution space.” We obsess over pixel-perfect designs, argue over feature prioritization, and optimize for engagement metrics2 while neglecting whether we’re even solving the right problem.

Don’t just take my word for it – let’s look at some eye-opening stats. According to a study by the product management software company Pendo, 80% of features in the average software product are rarely or never used. That’s a staggering waste of resources and a clear indication that we’re building many things our customers don’t want or need.

Conversely, companies prioritizing a deep understanding of their customers’ needs are far more successful. Take Intercom, the customer messaging platform, for example. In a blog post, they shared that while most companies spend about 10% of their time on problem definition and 90% on solution design and execution, Intercom flips that ratio. They spend roughly 40% of their time deeply researching and defining the customer problem before thinking about potential solutions.

The results speak for themselves—Intercom has grown to over $150M in annual revenue and is widely recognized as a leader in its space. By investing heavily in understanding its customers’ pain points (i.e., focusing more time on the problem rather than the solution space), Intercom can build products that solve real problems and create genuine value.

So why do so many Product Managers fall into the trap of over-focusing on the solution space?

Part of it is our natural bias for action—we want to feel like we’re making progress, and designing and building are tangible outputs we can point to. Exploring the problem space, on the other hand, can feel fuzzy and intangible.

Stakeholders often pressure us to “show me the designs” or “let me play with the prototype.” We feel like we need something visual to prove we’re making headway. But this can lead us to prematurely jump to solutions before we fully validate our understanding of the problem.

The danger, of course, is that we end up building products based on faulty assumptions. We assume we know what customers want, or we project our preferences onto them. But as the old adage goes, “You are not your user.” Just because something makes sense to us or seems like a cool idea doesn’t mean it actually solves a real customer need.

The result is products that miss the mark – features that go unused, interfaces that confuse more than they clarify, and wasted time and resources that could have been better spent elsewhere.

So what’s the solution? As Product Managers, we must resist the urge to jump straight to solutions and instead force ourselves to slow down and spend more time in the problem space. We must cultivate a deep curiosity about our customers’ lives, motivations, and challenges. We must validate our assumptions through rigorous research and testing. And we must be willing to pivot when the data tells us we’re on the wrong track.

By embracing the foundational layers of the Prouct-Market-Fit Pyramid and investing in a deep understanding of our target customers’ needs, we can avoid the pitfalls of over-focusing on the solution and, instead, build products that truly resonate and create value. It may not always be the fastest path, but it’s the surest way to achieve product-market fit and long-term success.

How Jobs-to-be-Done as a concept can help us learn from customers

So, we know that deeply understanding our customers’ needs is crucial. But how exactly do we go about uncovering those needs? One of the most powerful frameworks I’ve found for this is Jobs-to-be-Done (JTBD), pioneered by innovators like Clayton Christensen, Tony Ulwick, and our friend at Product Collective, Bob Moesta.

At its core, JTBD is based on a simple but profound insight: people don’t buy products or services; they “hire” them to get a job done. As Moesta puts it, “People don’t want a quarter-inch drill; they want a quarter-inch hole.” The drill is a means to an end – the real “job” is making the hole.

This might sound obvious, but it fundamentally shifts how we think about our products. Rather than focusing on features and functionalities, JTBD encourages us to zoom out and consider the higher-level outcomes our customers try to achieve.

For Product Managers, this is a game-changer. By understanding the real “job” our product is hired for, we can design solutions that meet customer needs rather than incrementally improving existing offerings. We can also identify opportunities for innovation by uncovering “jobs” that are currently underserved or poorly met.

But how do we identify these “jobs”? This is where the core components of the JTBD framework come in:

- Struggling Moments: These are the specific instances where a customer encounters a problem or frustration while trying to get a job done. By examining these struggling moments, we can pinpoint the real pain points our product should address.

- Push/Pull Forces: The pushes are about the circumstance that causes the struggling moment – and the pulls are based on the struggling moment and help you define what progress looks like. In a sense, you’re being pushed away from your struggle – and pulled to find a new solution.

- Anxieties: Customers often have fears and anxieties even when motivated to adopt a new solution. Will it be hard to learn? What if it doesn’t work as promised? Addressing these anxieties is key to driving adoption.

- Inertia: Going deeper than anxieties is when someone experiences inertia. Customers may be dissatisfied with their current solution, but the devil they know can seem preferable to an unknown alternative. Overcoming this inertia requires making the switch feel safe and easy.

To illustrate these concepts, I like to look at the real-life pain I’m constantly feeling – and the solution for that pain… is pizza. Luckily for me, in Lakewood, Ohio – there are so many great places to eat pizza… well over a dozen pizzerias exist just a couple of miles from each other. Three come to mind:

- Angelo’s Pizza: The tried-and-true Lakewood institution that’s been around for decades. It’s quintessential “Lakewood.” When Tom Hanks visits his former hometown, he often rents the entire pizzeria for himself and his friends.

- Harlow’s: This is more of a trendy bistro – great mood lighting, hipster decor, and an amazing wood-fired pizza oven. It’s perfect for a date night. Yes, the pizza is great… but the vibes are even better.

- Little Caesars: Okay, we’re probably all familiar with this one. It’s essentially fast food- pizza. You don’t even need to order it in advance. You can simply walk in and ask for a pepperoni pizza, and often, they’ll just turn around, grab one, and you’re off.

Which of these places do you think I often turn to? The answer is that it depends.

I’ll choose Angelo’s when I have friends from out of town and want to give them that Lakewood experience. But I’m not deciding between Angelo’s and Little Caesars. I’m probably deciding between Angelo’s and Melt… another well-known classic Lakewood eatery. I’m “hiring” Angelo’s for that classic Lakewood experience.

When rushing home from soccer practice… I’ll often choose Little Caesars. But it’s because I have about 45 minutes to get home, feed my kids, wash them, and get ready for bed. I’m “hiring” Little Caesars to help with that.

Each job involves different struggling moments, push/pull forces, anxieties, and inertia. By understanding these nuances, even a pizza company could design offerings tailored to each job rather than making a one-size-fits-all offering.

However, the same principle applies to software products. By deeply understanding the jobs your customers are hiring your product to do, you can design solutions that truly resonate and create value. However, uncovering these insights requires more customer research than we might be used to. Rather than just asking customers what they want, we must probe deeper into their motivations, struggles, and decision-making processes. This is where techniques like the JTBD interview come in, which we’ll explore in the next section.

For now, the key takeaway is this: by shifting our focus from product features to customer jobs-to-be-done, we can open up a whole new world of insights and opportunities. We can move beyond incrementally improving existing solutions to designing innovative offerings that meet customer needs.

Conducting Effective JTBD Interviews

We understand the importance of uncovering the deeper motivations and struggles driving customer behavior. But how do we do it? How can we conduct customer interviews that unearth these game-changing insights?

Learning directly from Bob Moesta, who has conducted thousands of JTBD interviews over the years, I’ve learned that there’s both an art and a science. Here are some of the key principles and techniques I’ve found most effective:

- Focus on the triggering event: One of the most powerful questions you can ask in a JTBD interview is, “What happened that made you start looking for a solution?” This gets to the heart of the struggling moment that catalyzed the customer’s search. Drill down into the specifics of this event—what was the context, what were they trying to accomplish, and what were the frustrations or pain points?

- Dig into the emotional dimension: JTBD is not just about functional but also social and emotional needs. Ask questions like “How did that make you feel?” or “What were you worried about then?” This can uncover the hidden anxieties and desires driving behavior.

- Map the consideration set: To understand the push/pull forces at play, probe into the alternatives the customer considered. What else did they look at, and why did they choose your product (or a competitor’s)? This can reveal the key decision criteria and value propositions that matter most.

- Uncover the obstacles: Inertia is a powerful force, so it’s crucial to understand what almost held the customer back from making a switch. Ask about their hesitations, doubts, and fears. What nearly prevented them from taking action, and what ultimately convinced them to take the leap?

- Use “story-eliciting” questions: Moesta advises that the best JTBD interviews feel more like conversations than interrogations. Instead of rapid-fire questions, use open-ended prompts encouraging the customer to share their story. “Tell me about a time when…” or “Walk me through the process of…” can yield much richer insights than “Do you like feature X or Y?”

- Embrace silence: It’s natural to want to fill awkward pauses, but some of the most profound insights come after a moment of reflection. If a customer seems to be thinking, resist the urge to jump in. Give them the space to process and articulate their thoughts.

- Follow the energy: If a customer seems particularly animated or emotional about a certain point, investigate. Don’t be afraid to deviate from your script if you sense a rich vein of insight to be mined. The best JTBD interviews are often the ones that go “off-road.”

Let me share an anecdote from my experience to bring these principles to life. A few years back, we were interviewing attendees of INDUSTRY: The Product Conference to help understand why they “hired” INDUSTRY in the first place. We had initial hypotheses about their needs but knew we needed a deeper understanding to nail the value proposition.

In one particular conversation with Matt – an Onboarding Lead – we found that one of the “jobs” he was hiring INDUSTRY for was to “level up” and “own being a Product Manager” even though he didn’t even have that title on his business card. He had communicated to his boss that he wanted to be a PM, and his boss encouraged him to take ownership of the job itself without yet having the title. For Matt, this was the “push”.

But we also discovered that while he was at INDUSTRY, he created his sketch notes and posted them on Twitter (now X). It would have been easy to assume he did this simply to impress his social media following. However, Bob Moesta, who helped us interview Matt, leaned in on this to understand the motivation for Matt’s sketch notes. It turned out that Matt was feeling pressure from his boss and colleagues to prove that this conference he came to was worth going to. They were spending a lot on ticket purchases, paying for travel expenses, and taking Matt out of his day-to-day. INDUSTRY wasn’t a conference his company was familiar with before Matt asked if he could attend. So Matt felt pressure to show that it was a worthwhile expense. And thus, he created sketch notes to share with his team back home.

This “aha moment” for us – uncovering anxiety that people must prove that the conference was worthwhile – led to changes in our marketing and helped us launch our best delighter feature ever. One example of the change in our marketing was sharing a “Convince Your Boss” document – a template potential attendees could use to modify and convince their boss of the value that INDUSTRY would bring them if they attended. But our Official Conference Notes is the best delighter feature we’ve ever launched. At every conference now, we hire a professional journalist and designer to take notes on every keynote talk, put together a nicely designed ebook on the fly, and share it with every attendee within 24 hours of the end of the conference. The first time we ever announced this feature on stage, our notetaker got a bigger ovation than any of our speakers!

Of course, only some interviews will yield such dramatic insights. However, by consistently applying the principles and techniques outlined above, you can build a robust practice of customer discovery that continually informs and strengthens your product decisions.

The beauty of JTBD interviews is that they’re not just a one-time exercise but an ongoing discipline. As your customer’s needs and context evolve, so should your understanding of their jobs-to-be-done. By making JTBD a regular part of your product development process, you can always stay attuned to the deeper motivations and struggles driving their behavior.

Quantitative vs. Qualitative Customer Feedback: Pros, Cons, and Use Cases

We have a wealth of techniques for gathering customer insights. Each method offers a different lens into customer behavior and preferences, from surveys to usage analytics to user testing. However, with so many options, knowing when to use which approach can take time and effort. Let’s explore the pros and cons of some common research methods and when each one is most effective.

Quantitative Methods: Quantitative research is all about the numbers. These methods are great for answering questions like “how many,” “how much,” and “how often.” Some standard quantitative techniques include:

- Surveys: Surveys are a quick and easy way to gather customer data. They’re great for gauging overall sentiment, measuring satisfaction, or validating hypotheses. The key is to keep surveys short, focused, and easy to complete. Too many questions or confusing language can lead to low response rates and unreliable data.

- Usage Analytics: Analytics tools like Mixpanel or Amplitude can provide a wealth of data on how customers use your product. You can track everything from feature adoption to user flows to retention rates. This information is invaluable for understanding where customers are getting stuck, what features are most popular, and how different segments behave.

- A/B Testing: A/B testing allows you to compare two versions of a feature or experience to see which performs better. It’s a powerful way to optimize everything from landing pages to onboarding flows to pricing models. The key is to test one variable at a time and to have a clear hypothesis about what you expect to see.

The great thing about quantitative methods is that they give you hard, objective data. You can measure, benchmark, and track progress over time. They’re also relatively quick and inexpensive, allowing you to gather insights at scale.

However, the downside of quantitative methods is that they don’t always tell you the “why” behind the numbers. You might know that users are dropping off at a certain point in your onboarding flow, but you will only know why if you ask them. Quantitative data can also be misleading if you ask the wrong questions or your sample doesn’t represent your broader user base.

Qualitative Methods: Qualitative research, on the other hand, is all about the stories. These methods are great for exploring the “why” behind customer behavior and for uncovering insights you might not have even known to look for. Some common qualitative techniques include:

- User Interviews: As discussed in the JTBD section, interviews are a powerful way to dig into customers’ motivations, struggles, and decision-making processes. They allow you to ask follow-up questions, probe for deeper insights, and understand the customer’s perspective. The downside is that interviews can be time-consuming and challenging to synthesize insights across multiple conversations.

- Usability Testing: Usability testing involves observing customers interact with your product and asking them to “think aloud” as they navigate. This can uncover confusion, frustration, or delight that might not appear in your analytics. It’s especially valuable for testing new features or redesigns before you roll them out to your whole user base.

- Diary Studies: In a diary study, you ask customers to record their experiences with your product over time. This could be as simple as jotting down notes in a text document or as involved as recording video logs. Diary studies are great for understanding how your product fits into customers’ daily lives and uncovering edge cases or infrequent issues.

The great thing about qualitative methods is that they give you rich, nuanced insights into the customer experience. You can explore areas you might have yet to think to ask about and build empathy for your users’ perspectives.

However, the downside of qualitative methods is that they can be time—and resource-intensive. You’re typically working with a smaller sample size, so it can be hard to know if the insights represent your broader user base. There’s also a risk of bias, both from the customers you select to participate and from your interpretation of the results.

So what’s better?

The answer is it depends.

In reality, the most effective research programs use a mix of both quantitative and qualitative methods. You might start with some broad surveys or analytics to identify areas of opportunity or concern, then dive deeper with interviews or usability testing to understand the root causes and generate ideas for solutions.

The key is to always start with your learning objectives. What do you need to know, and why? What decisions will this research inform? By clarifying your goals upfront, you can choose the methods that give you the most relevant and actionable insights.

Putting It All Together: Building a Customer-Obsessed Culture

As Product Managers, our ultimate goal is to build great products and create value for our customers. The only way to do that consistently is to cultivate a deep, ongoing curiosity about their needs, behaviors, and experiences. We must make customer learning a daily habit, not a one-off exercise. We must institutionalize practices and rituals that keep us constantly attuned to their feedback and insights. And we must evangelize this customer-obsessed ethos throughout our organizations, from the executive suite to the front lines.

Building this kind of continuous learning culture is challenging but essential for long-term product success. It requires a willingness to challenge our assumptions, embrace humility and empathy, and make time and space for regular customer interaction. It means celebrating and rewarding customer-centric behaviors and ensuring every decision is grounded in real user insights.

But the payoff is immense. By truly understanding our customers’ jobs to be done, we can uncover opportunities for innovation that our competitors have yet to see. By validating our hypotheses through rigorous research, we can mitigate the risk of building products no one wants. We can create products that meet needs and exceed expectations by continuously iterating based on customer feedback.

So, as you embark on your next product journey, keep these key takeaways in mind:

- Slow down and spend more time in the problem space, deeply exploring your customers’ jobs to be done.

- Conduct regular customer interviews, focusing on the triggering events, emotional dimensions, and obstacles driving their behavior.

- Leverage a mix of quantitative and qualitative research methods to validate your assumptions and uncover new insights.

- Cultivate a curious, humble, and empathetic mindset, and make customer learning a daily habit.

- Evangelize customer-centricity throughout your organization, and make sure every decision is grounded in real user needs.

By embracing these practices and mindsets, you’ll be well on your way to building truly customer-obsessed products. You’ll uncover insights your competitors have missed, validate your riskiest assumptions, and create experiences that satisfy customers and delight them.